Introduction

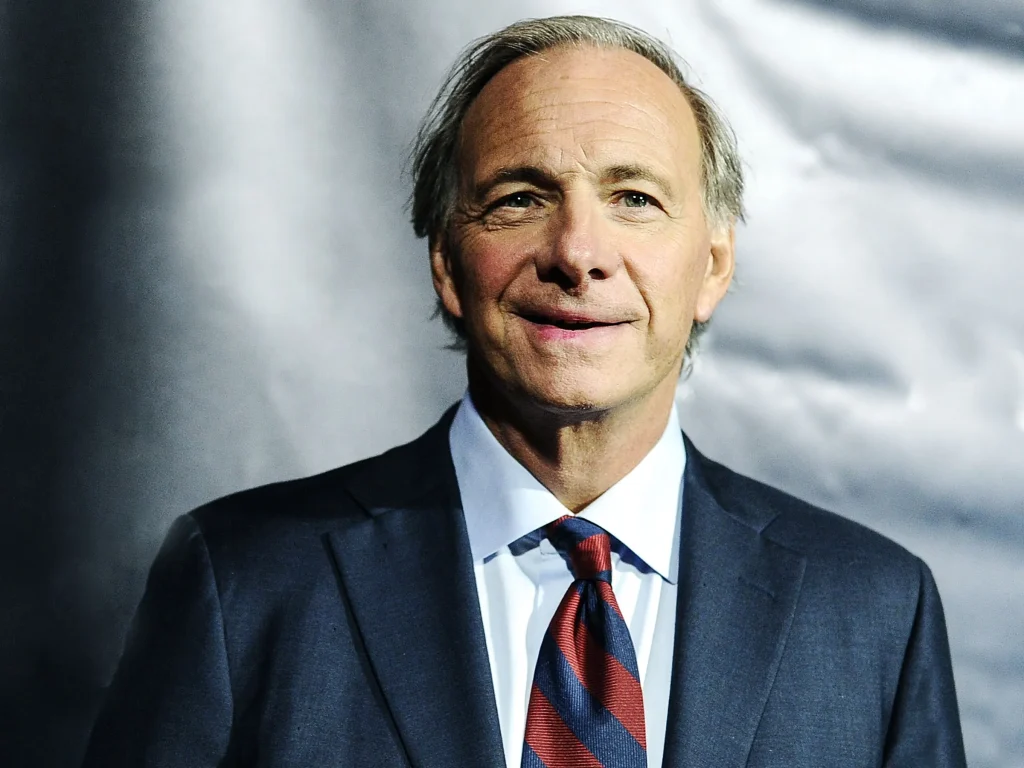

In the world of global finance, few names command as much respect, influence, and intellectual weight as Ray Dalio. Founder of Bridgewater Associates, the world’s largest hedge fund for decades, Dalio has long been regarded as one of the most thoughtful investors of modern times. His principles on markets, leadership, and economic cycles have shaped how institutions, governments, and investors understand risk and opportunity.

While Ray Dalio is widely associated with Wall Street and the rise of hedge funds in the United States, his global outlook has increasingly drawn him toward the Middle East. Over the past few years, Dalio has built a strong presence in the United Arab Emirates, particularly through Abu Dhabi, while maintaining deep connections across the UAE including Dubai.

His presence in the region reflects more than personal preference. It signals a broader shift in global capital, influence, and financial leadership toward the Gulf. As the UAE positions itself as a global financial and investment hub, Ray Dalio’s engagement reinforces the country’s growing role in shaping the future of global markets.

This is the story of Ray Dalio’s journey, his investment philosophy, and why the UAE has become a strategic base in his global worldview.

Early Life and Intellectual Foundations

Raymond Thomas Dalio was born in 1949 in Jackson Heights, New York. His background was far from elite finance. His father was a jazz musician, and his mother was a homemaker. From an early age, Dalio showed curiosity rather than privilege. At just 12 years old, he took a job as a golf caddie, where he was exposed to wealthy investors and business leaders.

It was during those early years that Dalio overheard conversations about the stock market. Fascinated by the idea that money could grow through intelligent decision making, he began investing small amounts on his own. One of his earliest investments, a modest purchase of airline stock after the industry was deregulated, tripled in value. That moment planted the seed for a lifelong obsession with markets.

Dalio went on to study finance at Long Island University and later earned an MBA from Harvard Business School. Unlike many of his peers, he was less interested in corporate careers and more focused on understanding how economic systems worked at a macro level.

He was particularly drawn to cycles. Why economies rise and fall. Why debt expands and contracts. Why empires flourish and decline. These questions would become central to his life’s work.

The Birth of Bridgewater Associates

In 1975, Ray Dalio founded Bridgewater Associates from his apartment in New York. The firm started as a modest advisory business providing economic research and currency risk analysis to corporate clients.

What set Bridgewater apart early was Dalio’s insistence on understanding cause and effect. He believed markets were driven by timeless principles that could be studied, documented, and repeated. While many investors relied on intuition or short-term signals, Dalio focused on long-term patterns.

Over time, Bridgewater evolved into a hedge fund focused on global macro investing. The firm analyzed interest rates, currencies, inflation, debt cycles, and government policy to anticipate major shifts in the global economy.

By the 1990s and early 2000s, Bridgewater had grown into a powerhouse. Its flagship strategy, Pure Alpha, became one of the most successful hedge fund strategies in history. Major institutional investors including pension funds, sovereign wealth funds, and central banks entrusted Bridgewater with managing billions of dollars.

At its peak, Bridgewater managed over 150 billion dollars in assets, making it the largest hedge fund in the world.

Principles Over Personality

Ray Dalio’s leadership style is as famous as his investment success. At Bridgewater, he built a culture centered on radical transparency and idea meritocracy. Employees were encouraged to challenge one another openly, regardless of seniority. Meetings were recorded. Feedback was constant and often brutally honest.

Dalio believed that truth and transparency were essential for long-term success. He documented his philosophy in his widely read book Principles, which became a global bestseller. The book was not just about investing, but about decision making, leadership, and personal growth.

While some criticized Bridgewater’s culture as intense or unconventional, Dalio saw it as necessary. In his view, avoiding hard truths leads to poor decisions, especially in environments as complex as global finance.

This philosophy also shaped his approach to global economics. Dalio does not see markets as random. He sees them as systems governed by repeatable patterns. This systems thinking would later inform his views on geopolitics and the shifting balance of global power.

Understanding the World Order

In recent years, Ray Dalio has become increasingly vocal about what he calls the changing world order. According to Dalio, history moves in long cycles. Nations rise, dominate, accumulate debt, and eventually decline, making room for new powers.

He has written extensively about the historical transitions between empires, from the Dutch to the British to the American era. In his analysis, the world is entering a period of transition marked by high debt, internal conflict, and shifting global influence.

This worldview has naturally drawn Dalio toward regions that are rising rather than declining. The Middle East, and the UAE in particular, fits this narrative.

The UAE combines financial stability, geopolitical neutrality, capital availability, and long-term vision. It is building institutions designed to last for generations rather than election cycles. For an investor focused on long-term systems, this alignment is difficult to ignore.

Deepening Ties with the UAE

Ray Dalio’s relationship with the UAE has strengthened significantly over the past decade. He has worked closely with sovereign wealth funds, advisory boards, and policymakers in the region.

Abu Dhabi has become a central base for his regional activities, particularly through partnerships with major investment institutions. At the same time, Dubai plays a critical role as a financial, commercial, and lifestyle hub that complements Abu Dhabi’s capital strength.

Dalio has praised the UAE for its long-term thinking, efficient governance, and openness to global talent. He has often highlighted the region’s ability to make strategic decisions quickly while maintaining stability.

Unlike short-term capital flows, Dalio’s involvement in the UAE reflects confidence in the country’s future. It aligns with his belief that capital should move toward environments that are prepared for the next 50 to 100 years.

Why Dubai Matters in Dalio’s Global Strategy

While Abu Dhabi anchors institutional investment, Dubai provides something equally important. Connectivity.

Dubai is one of the most globally connected cities in the world. It sits at the intersection of Europe, Asia, and Africa. For global investors, it offers access to emerging markets, capital flows, and entrepreneurial ecosystems that are difficult to replicate elsewhere.

Dubai’s financial infrastructure, regulatory evolution, and business environment allow firms and investors to operate efficiently across borders. For someone like Dalio, who studies global interdependence, Dubai acts as a living laboratory for how modern financial hubs function.

The city also reflects a broader shift in where influence is exercised. In the past, financial power was concentrated in New York and London. Today, it is increasingly distributed across hubs like Dubai, Singapore, and Hong Kong.

Dalio’s presence in Dubai underscores this reality.

Life and Work in the Region

Despite his immense wealth, Ray Dalio is known for maintaining a disciplined and thoughtful lifestyle. He spends significant time reading, writing, and reflecting on global trends. His days are structured around learning and analysis rather than social display.

Those who have interacted with him in the UAE describe him as deeply engaged and curious. He listens carefully, asks probing questions, and values perspectives from different cultures.

The UAE’s emphasis on safety, discretion, and quality of life suits Dalio’s personal style. It allows him to operate at a global level without distraction, while remaining close to some of the most important capital pools in the world.

Influence Beyond Finance

Ray Dalio’s influence extends far beyond hedge funds. Governments, policymakers, and corporate leaders study his work to understand risk and resilience. His insights on debt cycles and economic balance are referenced in boardrooms and ministries alike.

In the UAE, his thinking aligns with national strategies focused on diversification, long-term investment, and economic resilience beyond oil. His presence reinforces the country’s ambition to be not just a regional player, but a global thought leader in finance and governance.

Dalio has also emphasized the importance of education, social cohesion, and adaptability. These themes resonate strongly in a country that is investing heavily in human capital and innovation.

The Broader Message

Ray Dalio’s connection to the UAE is not about relocation headlines or lifestyle branding. It represents something deeper. A convergence of long-term thinking, capital discipline, and strategic foresight.

As global uncertainty increases, investors are drawn to environments that offer clarity, stability, and vision. The UAE has positioned itself as such an environment. Dalio’s engagement validates that positioning at the highest level.

His story also highlights a broader shift. The future of global finance will not be dictated by one country or one city. It will be shaped by networks of capital, ideas, and leadership across multiple hubs. Dubai and Abu Dhabi are now firmly part of that network.

Conclusion

Ray Dalio’s journey from a young caddie in New York to one of the most influential investors in history is a testament to curiosity, discipline, and long-term thinking. His decision to deepen his presence in the UAE reflects the same principles that built Bridgewater Associates.

In a world undergoing rapid change, Dalio seeks systems that endure. The UAE offers exactly that. Stability without stagnation. Ambition without chaos. Vision backed by execution.

By engaging with the region, Ray Dalio is not just observing the future of global finance. He is helping shape it.

And as Dubai and the wider UAE continue to rise as global financial centers, Dalio’s presence stands as a signal to the world. The center of gravity is shifting, and those who understand cycles are already positioning themselves accordingly.